My Top 10 Money Rules💰

How to create your own money rules & four resources for your personal finance glow-up

Hi fabulous readers!

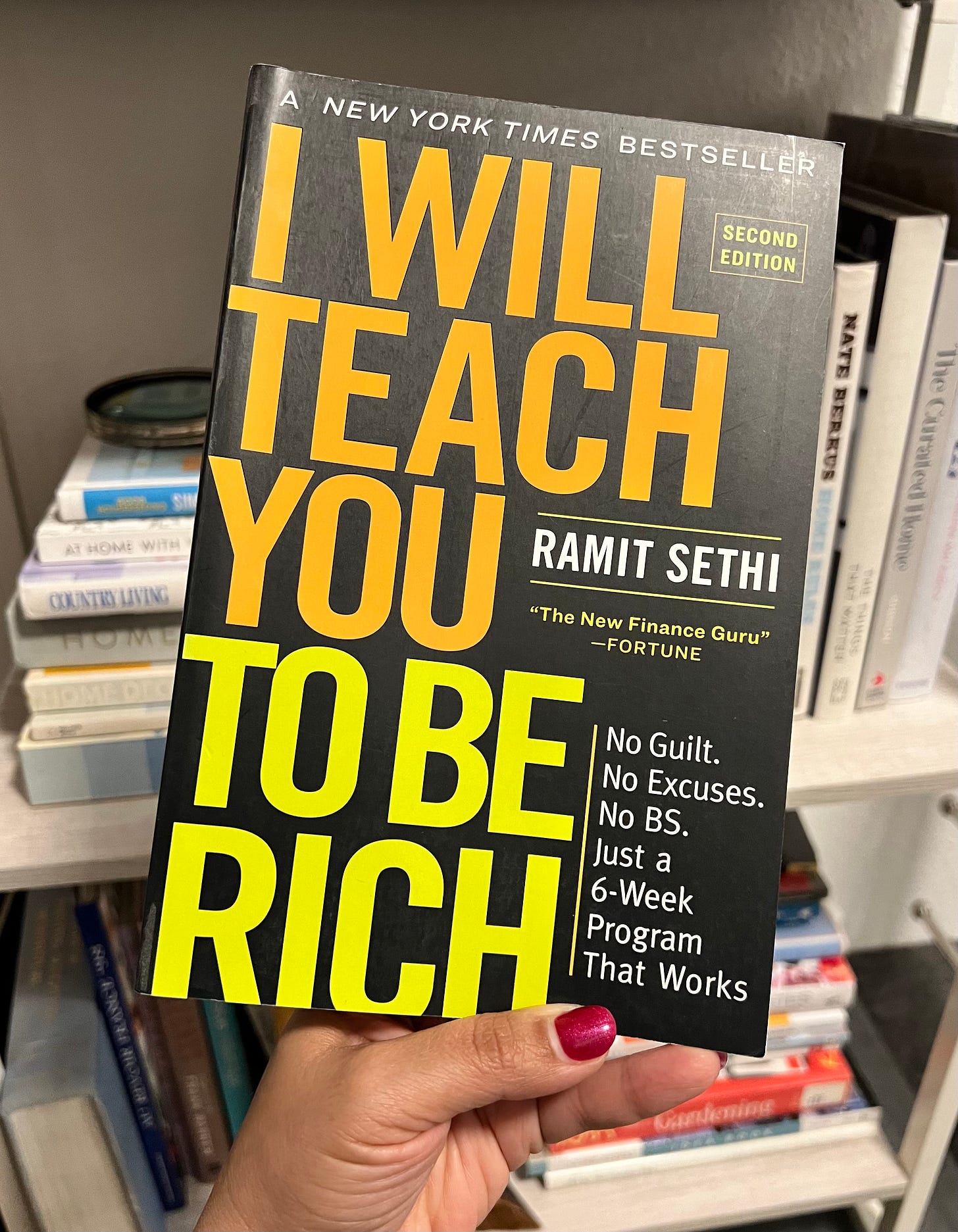

Imagine your finances are like a cluttered closet. You know there's good stuff in there, but it's buried under a pile of "I'll deal with it later." Enter Ramit Sethi with "I Will Teach You to Be Rich," ready to roll up his sleeves and help you Marie Kondo the hell out of your financial life.

Sethi breaks it down with a 6-week plan that's less "ugh, homework" and more "huh, why didn't I start sooner?" Think of it as a fitness routine for your wallet—initially challenging but seriously rewarding.

He tackles credit cards, savings accounts, and even how to buy a car without feeling like you got played. It’s finance with a side of humor, like learning to budget from a buddy who refuses to let you fail.

This isn't about pinching pennies or giving up your daily coffee; it's about smart moves: automating savings, investing without the headache, and spending guilt-free on what you love.

In fact, Sethi promotes the idea that you should have 10 money rules to help you create a life you love. These rules are a set of personal financial principles that align with your dreams, values and day-to-day life.

I have to say that after reading his book and applying his tips, it's like I've unlocked a new level of life where my finances fuel my joy instead of feeding my stress. It’s been a total game-changer for me!

So, armed with Sethi’s wisdom, I’ve crafted my own set of money rules that have guided me from financial chaos to clarity. Without further ado, let’s dive into the 10 money commandments that have become my roadmap to navigating personal finance with a bit more grace and a lot less facepalming.

Sandra’s Top 10 Money Rules

1. If the flight is more than three hours, buy business class.

Business class, please! You know, there comes a time in life when you realize your comfort is worth the splurge—especially when flying longer than a Lord of the Rings movie. For me, that’s any flight over 3 hours. My economy days are behind me, as are the aches and pains from playing Tetris with my limbs. Investing in business class means I’m not only paying for space but for an experience that leaves me refreshed rather than frazzled. Imagine sipping on that welcome champagne while stretching out with enough legroom to host a small yoga class—that’s my kind of travel.

2. Get a financial divorce for a happier marriage.

This may be controversial, but my husband Speed and I realized our relationship works better when our bank accounts aren’t trying to tango. It was like deciding who gets the last slice of pizza without starting World War III—a game-changer. Now, I handle my money, Speed handles his, and our only financial rendezvous is plotting for big dreams like that vacation to the Amalfi Coast or buying a car for our son Max (OMG I can’t wait for him to get his license). It’s stress-free, and we’re still on the same page where it counts, just without the bickering over every nickel and dime spent on coffee or comics.

3. Give every dollar a job, YNAB style.

Ever since I got cozy with YNAB (You Need A Budget), it’s been a financial eye-opener. The cornerstone of YNAB's approach is its first rule: Give Every Dollar a Job. It's all about being intentional with each dollar, whether it's earmarked for the ‘essentials' like our internet connection lifeline or the 'nice-to-haves' like my sushi and cappuccinos. Plus, setting aside money for debts and savings has never been simpler, transforming financial management from a guilt-laden chore into a clear-cut strategy. Case in point: I noticed a bit of a splurge trend on takeout (guilty as charged—I'm a foodie at heart) and decided to reroute some of that cash to my travel fund (because, well, wanderlust wins).

4. If it’s a bucket list experience, go VIP.

Why squint from the cheap seats when you can practically high-five the excitement up front? Take Max's first birthday – we celebrated in style at a PSG game in Europe, front row, making the action jump out in a way that no TV broadcast could match. For Father's Day 2022, Speed lived the dream with a MotoGP VIP experience, complete with champagne and behind-the-scenes tours. And for my 45th? Speed pulled off a Beyonce concert with VIP tickets. We were so close, we could feel the breeze from her hair flips! These weren't just splurges; they were epic experiences that beat any material gift, hands down. Because, let's face it, splurging on those once-in-a-lifetime memories? Absolutely worth it.

5. If a book is brain candy, get it free; if you’ll refer to it often, pay for the physical book.

My reading habit could easily break the bank if not for Libby and Bookbub, where I snag my paranormal romance novels (don’t judge me) on a budget or even free. For the stuff that's supposed to make me a better, more well-rounded human—like self-help, globetrotting guides, and how to make my living room not look like a college dorm—I'll actually shell out for the hardbacks. There's just something about flipping real pages that beats scrolling any day. And for those months when my reading list is longer than a Target receipt, Kindle Unlimited is my go-to. I can binge-read without waiting and without remorse, like the time I devoured the entire ACOTAR series in a weekend. #TeamRhysand

6. Set aside a monthly stipend for your hobbies.

Setting aside a little cash for hobbies—even if it's just a twenty-spot each month—can really spice up your life. It sure did for mine. Picture this: me, gleefully throwing money at jigsaw puzzles and fancy pens for journaling, basking in the glory of zero buyer's remorse. As my wallet got a bit fatter, so did my hobby fund, paving the way for adventures like blogging courses that produced, um, nothing yet BUT IT’S IN PROGRESS! Think of it as your personal green light to chase after what tickles your fancy, sans the guilt. It's like telling your inner child, "Go on, get the giant Lego set. You deserve it."

7. If furniture has fabric, buy new; otherwise used is fine.

New or used? For me, it depends on the backstory. My rule: if it’s cozy and fabric-covered, like the cloud-like sofa in my living room, it comes new to avoid any mysterious pasts. But for sturdy stuff like wood or metal, I hunt for treasures at antique or consignment shops, even Facebook marketplace, Bookoo (in Germany) or Craigslist (in the US). I found a French vintage sideboard that perfectly holds all my fancy glassware, and a gorgeous gilded mirror for a steal! For the finishing touches? A quick trip to TJ Maxx hooks me up with unique accessories that scream personality, not price tag.

8. Always budget for eating out on a weekly basis.

You ~know~ you’re going to eat out at least once this week. We’re ALL probably going to eat out at least once this week! With a life that often feels like it’s in fast-forward, budgeting for eating out isn’t just practical; it’s a necessity. By reviewing past spending, I realized we were doing a weekly family dinner out. Who wants to cook on a Friday night?! So, I budgeted accordingly, turning what could be a financial hiccup into a planned highlight of our week. We embraced the convenience without sacrificing our financial sanity.

9. Spend no more than $35,000 on a car.

My hard cap? $35,000, out the door. Honestly, there isn't a car on this planet that could convince me it's worth more—unless it doubled as a self-driving maid and a personal chef. That golden rule steered me towards my current set of wheels: luxe vibes without the luxe cost. It's all about striking that perfect harmony between what you want and what actually makes sense, kind of like nabbing a high-end espresso machine for the price of a regular joe. SUCH a great feeling!

10. Pay in full whenever possible.

Embracing the pay-in-full philosophy has been a game-changer, especially for no-brainer buys. It helps me pad my wallet and lands me some sweet deals on everything from binge-worthy streaming services to those Substack reads that feed my brain. I reserve the monthly option for test-driving new services, with a strict one-month verdict deadline to either bail or go all in for the year. And pro tip: November reigns supreme as the prime time for catching deals, all thanks to the Black Friday frenzy. That’s when I buy everything: presents for everyone AND for myself!

How to create your own money rules

Now you might be asking, "How do I even start creating my own set of money rules?" No sweat—Ramit Sethi has laid out a blueprint that’s as down-to-earth as it is genius.

First up, turn detective on your own spending. See any trends? Do you have one subscription that's more joy than junk, or a gym membership that's gathering dust? Figure out what makes your wallet happy and what doesn’t.

Next, let your imagination run wild about where you want your money to take you. Dreaming of financial freedom, a home that’s all yours, or a retirement filled with gold? Your money rules are the foundation of these dreams. Ramit encourages a blend of pinpoint accuracy and a roll-with-the-punches mentality because, let’s face it, life’s full of surprises.

And don’t forget to weave your personal values into your rules. If you’ve got wanderlust, earmark funds for travel. A thirst for knowledge? Set aside some cash for learning. Get your money in tune with your lifestyle.

Resources I love for learning about basic personal finance:

I Will Teach You To Be Rich by Ramit Sethi for aligning your money to your values

The Total Money Makeover by David Ramsey for paying off debt fast

Personal Finance Club free mini-course for beginner investors

Wrapping Up

With Ramit Sethi's help, I've turned my financial chaos into pure bliss. His approach is like a workout for your wallet—practical and rewarding. From credit cards to investments, Sethi's tips make managing money a breeze. It's not about sacrifice, but smart choices that match your dreams. Now, armed with his wisdom, it's time to craft your own 10 money commandments. Take your time, refine your mantra, and embark on your financial journey with confidence. So, what are you waiting for? Grab that pen or open your notes app—it's time to write your financial fairy tale.

Bonus tips:

Let’s Discuss:

What’s one of your Top 10 money rules?

Ooooh, I love your garden analogy! Yes, wedding every so often is so important. I’m regularly looking at my budget and realigning my funds to my priorities. There money commandments and YNAB make this process so much faster and easier. Have fun wedding your money garden! 💴 🪴

"Give every dollar a job" - this is great! And the idea to create your own "Money Commandments" is great! I'm going to do this over the next week with my husband. I always think of money like a garden. The more we pay attention, the more it blooms and this post reminded me to get back into my accounts and weed! Thank you, Sandra!